Frequently Asked Questions

What is the Annabel Foundation?

The Annabel Foundation is a family administered Christian charity established in 2008 which has a heart for assisting ministry students by partnering with them to amplify their financial support.

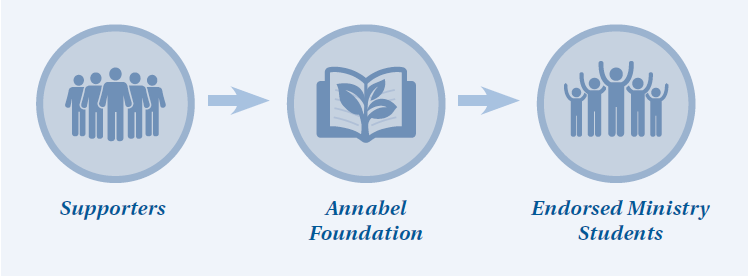

The Annabel Foundation seeks to serve God and the Church by maximising financial outcomes for students who are called to ministry and undertaking theological study.

We assist in the training of Christian workers in Australia by receiving donations which are then disbursed to endorsed ministry students as bursaries, thereby facilitating greater financial support leading to a less stressful time as students go through their course.

The Annabel Foundation received Deductible Gift Recipient (DGR) status from the Australian Taxation Office on incorporation in 2008. Donations over $2.00 are tax deductible.

The Annabel Foundation supports a wide range of ministry students incorporating many differences eg geographic location, study load, subject focus, learning styles i.e. vocational through to degree level courses.

How does the Annabel Foundation assist endorsed students?

The primary form of assistance the Annabel Foundation provides to its endorsed students is by way of partnering with them to offer their existing (and hopefully increasing) supporter network the means to amplify their giving by receiving a tax deduction on their donation.

After a donation is received by the Annabel Foundation the donor can receive a tax deduction. The donations are then disbursed to eligible ministry students in need who have been endorsed by the Foundation, in the form of a bursary.

To become an endorsed student, you must apply through the links on the website and be approved by the Annabel Foundation.

There are a few requirements that the Annabel Foundation must comply with as mandated by the Australian Taxation Office:

- We cannot give tax deductions for donations given from any family member of a bursary recipient.

- We cannot accept donations that direct the amount toward a specific recipient. However, a recommendation can be put forward for a specific training provider.

If this is the case, the Annabel Foundation will assess the recommendation and make a final decision.

Australian Taxation Office regulations require that a donation must be donated unconditionally, without a demand that the funds be allocated to a specific student. For example, a family member may not donate to the Annabel Foundation and demand the donation be allocated to their endorsed family member. The funds would be allocated appropriately by the Annabel Foundation.

Why does the Annabel Foundation provide bursaries and not scholarships?

Historically in academia financial assistance for students has been by way of scholarships. These are usually highly competitive and assessed on the academic capabilities of the applicant against a pool of other applicants.

A bursary is based on financial and other needs and does not have a specific academic benchmark that needs to be achieved. Bursary allocations are assessed on a standalone basis.

The Annabel Foundation rejoices when ministry students who receive our bursaries achieve good grades and we encourage academic excellence but it is not a dominant factor in our decision whether or not to award a bursary to an applicant.

What does tax deductibility mean?

Your taxable income is the income that you have to pay tax on. When something is tax deductible, the purpose of it is to decrease your taxable income, which would then mean decreasing the amount of tax you have to pay to the government.

Australia has a progressive system which means that the more you earn, the more tax you pay. Tax deductions, (i.e. a donation to the Annabel Foundation) counts as an expense that can reduce your taxable income.

Why would I donate through the Annabel Foundation and not straight to the student?

By donating through the Annabel Foundation, you are able to obtain a receipt which will allow you pay less tax at the end of the financial year. For example, if you donate $100 directly to a student, you are spending $100. If you donate through the Annabel Foundation, the student receives a donation and you also pay less at the end of the financial year.

How are donations allocated?

The Annabel Foundation levies a 10% service charge. From 2008 to 2014, the Annabel Foundation Founders met all the administrative costs. This became unsustainable and did not allow the Foundation to grow. 90% of the donation is allocated directly to ministry students whose applications have been endorsed to receive bursaries. For more information on how the service charge is used to assist the Foundation to grow and assist even more ministry students click here.

Why do ministry students need donations?

Many of our students have families and making a decision to study can take a huge financial toll on them and their families. The Annabel Foundation want to ease the financial toll that studying can have. Studying full time can diminish, or remove, a person’s ability to work and meet their financial needs; we are able to help by allocating to them the donations that the Annabel Foundation receives.

It is important that ministry students feel supported. This can be an enormous and trialling change on an individual and this deters many people from beginning studying at all. We want to encourage ministry students to study and further God’s word. We want to enable our future teachers, ministers and worshipers.

Will donors receive a receipt for their donation?

Donors receive a tax deductible receipt as proof of their donation.

What can a bursary recipient spend their bursary on?

Bursaries can be allocated to direct educational expenses like IT, course fees, textbooks, stationery etc or more generally to living expenses that need to be met whilst undertaking the course of study.

Does the Annabel Foundation provide ongoing support to ministry students?

In addition to bursaries from donations received with recommendations, the Annabel Foundation from time to time can provide endorsed students with bursaries from non self-generated sources as they are available. Students are also welcome to re-apply for multiple bursaries as they progress through their course of study. We have many years experience mentoring ministry students and also provide other forms of support whenever required, i.e. prayer support, networking contacts etc.

Who is eligible to apply for an Annabel Foundation bursary?

Australian Taxation Office regulations mandate that bursary applicants must be an Australian citizen or hold permanent residency status before receiving any bursary monies.

Sign up for our Newsletter: